At times, the financial markets may feel detached from reality. In fact, a client recently compared the current environment to a movie and suggested Federal Reserve Chair Jerome Powell as the Wizard of Oz (you can use your imagination to find other political figures to be the Tin Man and Scarecrow). Whether or not you believe the Federal Reserve is “pulling the strings behind the curtain”, policy actions are a major force in dictating the movement of the markets and economy, and right now, the path ahead seems less certain.

In his speech at the annual Jackson Hole Fed Policy Symposium this year, Chair Powell highlighted this uncertainty by concluding that the Federal Reserve was “navigating by the stars under cloudy skies”. It sure feels like it. The market has reacted accordingly since those comments in August and evidence of the remarks can be seen in prices/yields of CDs, stocks, and bonds.

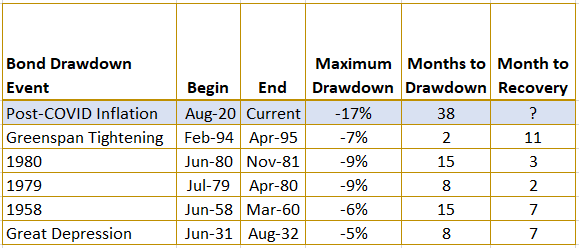

Among this trio of asset classes, bonds would have to identify as the bear. In fact, this is likely the biggest and longest bear market in bonds for most of our professional lives. As seen in the chart below, through the end of September, the current drawdown in prices is more than double the pain from both a time and price standpoint compared to the early 1980s.

Source: https://www.northerntrust.com/canada/insights-research/2022/wealth-management/a-history-of-drawdowns with Maximum Drawdown current data updated as of 10/2023.

Unfortunately, it hasn't felt much better for stock investors either. At the time of this writing, the price level for the S&P500 index is still more than 10% below its value at the end of 2021 (almost two years ago). Not only that, but many investors feel much worse as the average stock in the index remains down for the year, and despite all of the excitement for the “magnificent 7” large cap stocks this year, they have yet to recover the full amount of their maximum drawdown that occurred last October.

.png?width=675&height=554&name=image002%20(2).png)

Even with the headline S&P 500 up approximately 10% this year, many other parts of the market are flat and down. You’ll notice below that both the Dow Jones and Russell 2000 are flat to down this year. Beneath the surface, a large number of sectors are also down including financials (-1.6%), healthcare (-4%), consumer staples (-5%), utilities (-14%), and real estate (-10%). Altogether, the underlying volatility and individual equity ownership experience hasn’t felt very reassuring.

.png?width=1017&height=225&name=image003%20(1).png)

The good news is that these are all shorter-term experiences rather than long-term trends. Eventually the sky becomes less cloudy. Plus, all of this negativity for stocks and bonds has caused investors to rush, and hide, in the perceived and relative safety of CDs and money market funds with historically attractive yields. Contrary to the returns of the last two decades, these investments are now viable alternatives offering current yields exceeding 5% in some cases. However, this is a good time to remember that all investments have risks and rewards; and no big reward comes without comparable risk (or opportunity cost).

As always, this is why we advocate for education and understanding of your portfolio objectives, and a diversified approach for achieving your goals (For more information and investment-specific detail about the current market environment, XML President, Curtis Congdon, has shared another insightful video here). When navigating a cloudy or uncertain environment, diversification can be a winning strategy. Not only is diversification your friend in an uncertain environment, but income and cash flow may be your best friend. Adding income and cash flow to a diversified portfolio can help serve as an excellent roadmap – or yellow brick road if you will.

In conclusion, the flip side of all the negative sentiment and uncertainty in the economy is the positive opportunity to pursue options for attractive total return potential from all three of the discussed asset classes – CDs, stocks, and bonds. In other words, the brick road is much wider now. Although it may still be difficult to navigate at times, we are always happy to walk on this road by your side and be your partner to help you accomplish your goals.

.png)

.png?width=300&height=300&name=Untitled%20design%20(34).png)

.png?width=300&height=300&name=Untitled%20design%20(43).png)