In general, IRS audits are primarily a concern for people who are still working. Retirees tend to claim fewer refundable credits and have less complex tax returns, so the audit rate for this group is typically lower. Even though retirees are less likely to be audited, it’s still a possibility—and it pays to be prepared.

There are a number of factors that can cause the IRS to take a closer look at your tax return.

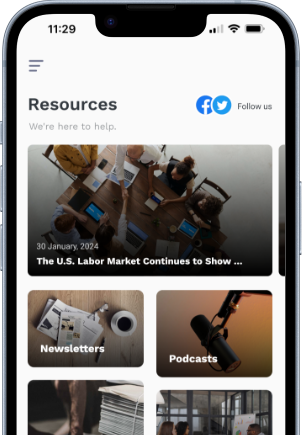

Click here to read the article.

This communication is for informational purposes only. No content or reference to a third-party article is intended to be a recommendation for the sale or investment in any product, strategy or service nor should it be perceived as individual advice. This commentary does not necessarily reflect the opinions of all employees or XML Financial Group and its affiliates (“XML”). XML is not responsible for any actions taken related to this information.

XML Financial Group and its Wealth Advisors are not licensed tax or legal professionals. These materials are not intended to be used, and cannot be used by any taxpayer, for the purpose of avoiding penalties that may be imposed on the taxpayer under U.S. federal tax laws. Individuals should consult their personal tax or legal professional regarding tax filings, such that may be required for certain trusts, retirement and ERISA plans, and any tax- or legal-related investment decisions.

.png?width=300&height=300&name=Untitled%20design%20(34).png)

.png?width=300&height=300&name=Untitled%20design%20(43).png)